Welcome back to Impact Theory with Tom Bilyeu. Today, we dive into the future of currency in an electrifying clip featuring financial heavyweights Peter Schiff and Raoul Pal. As blockchain technology continues to gain momentum, Raoul Pal paints an optimistic picture of its widespread adoption. Meanwhile, Peter Schiff offers a critical perspective, questioning bitcoin’s practicality and stability as a currency.

Tom Bilyeu navigates this riveting discussion, exploring whether bitcoin can truly function as a reliable medium of exchange or if it’s simply a speculative bubble waiting to burst. We delve into Peter Schiff’s investment strategies, his views on gold as a safe haven, and his skepticism about Amazon and tech markets. Raoul Pal counters with his enthusiasm for the transformative potential of blockchain and his approach to speculative investing.

Join us as we compare gold to bitcoin, discuss the impact of market volatility, and understand the psychology behind speculative investments. Whether you’re a blockchain believer or a bitcoin skeptic, this episode promises insightful debates and thought-provoking arguments. Don’t miss it!

Watch the full episode here: https://www.youtube.com/watch?v=xfHCly1ZCQ0

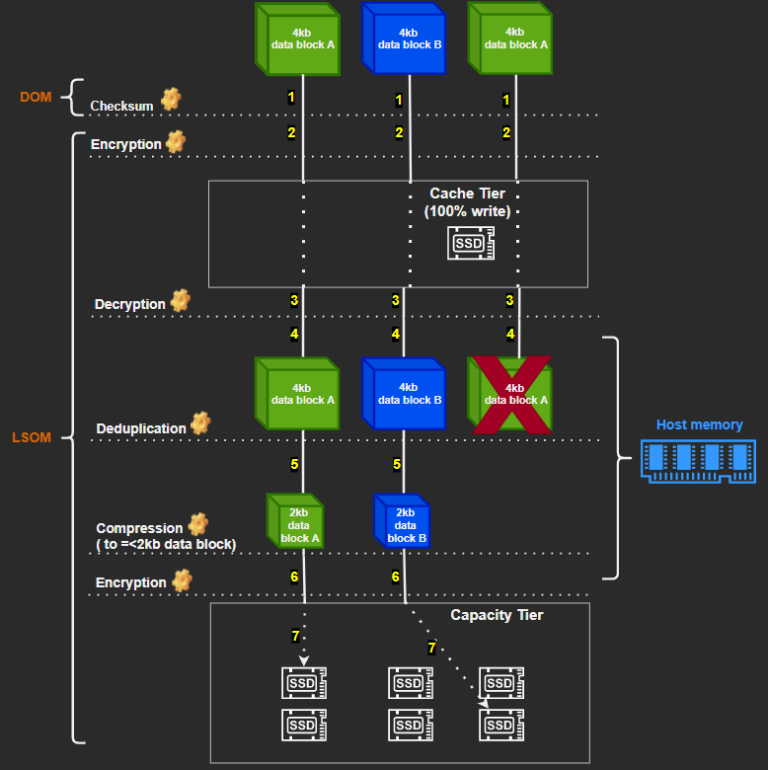

blockchain technology, bitcoin skepticism, bitcoin adoption, blockchain trust, blockchain security, Federal Reserve trust issues, futures market trust issues, speculative investment, Nasdaq index, technology companies, 1999 tech stock frenzy, market bubble, gold store of value, gold safe haven, real estate investment, Amazon investment critique, Amazon valuation, digital world dominance, bitcoin inflation hedge, bitcoin speculative investment, bitcoin investment risk, widely adopted currency, medium of exchange stability, undervalued assets, gold stocks appreciation, cryptocurrency community, missed Bitcoin opportunities, past financial bubbles, cryptocurrency promotion, bitcoin intrinsic value, bitcoin mining value