Customer acquisition costs can ruin a business. Some merchants limit acquisition spend to the gross margin of the first sale. Others look to customers’ lifetime value.

Yet Taylor Holiday, CEO of the agency Common Thread Collective, profits from acquisition marketing. He calls it “negative CAC.”

Taylor first appeared on the podcast in 2020. In our recent conversation, he explained his acquisition strategy, experiences with employee ownership, and more.

The audio from our entire discussion is embedded below. The transcript is condensed and edited for clarity.

Eric Bandholz: Give us the rundown.

Taylor Holiday: I’m the CEO of Common Thread Collective, an ecommerce marketing agency that helps brands grow predictably and profitably. We’ve been at it for over a decade. Recently, we partnered with Acacia, a private equity firm, to expand our platform and pursue the next phase of growth.

We operate with an employee stock ownership plan, an ESOP. Our company took a bank loan to buy 20% of equity from existing shareholders and placed it in a trust for employees. Shares are allocated annually based on each employee’s salary as a percentage of total payroll. For example, if payroll is $1 million and you earn $100,000, you’d get 10% of each share allocation.

Employees receive shares tax-free, with no purchase cost. If they leave, the company must buy back their shares, making them relatively liquid. ESOPs can buy out partners or provide owner liquidity, but they require education, vesting schedules, and carry liabilities on the balance sheet. Well-known companies like King’s Hawaiian are fully employee-owned.

Bandholz: Would you do it again?

Holiday: Probably not. Employees didn’t fully understand the ESOP, and it didn’t change behavior as I’d hoped. Plus, it complicates an eventual sale of a business, and the operational challenges are significant.

There’s a book on “community capitalism” that explores alternatives to pure capitalism and socialism. Capitalism can overly concentrate wealth, while socialism has its flaws. Many people sense the shortcomings of both systems but haven’t found a perfect alternative. For me, the ESOP wasn’t that solution. It was a noble attempt, but I don’t believe it resolves the core issues — and maybe nothing fully can, given human nature.

Bandholz: Before this interview, you referenced negative customer acquisition costs. Can you talk about that?

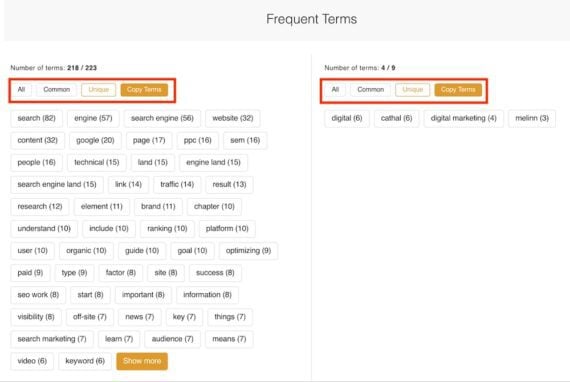

Holiday: Negative CAC means our marketing generates profit instead of being a cost. Initially, our podcast, videos, and email newsletter were purely for lead generation — effective but costly to scale. We realized these were valuable media assets for which companies, especially software vendors in our space, would pay to access our audience.

By selling sponsorships to our podcast, email list, YouTube channel, and social content, we offset production costs and, in some cases, made them profitable. This shift turned marketing into a profit center, improving margins and fueling growth.

There’s currently high advertiser demand, but a limited supply of quality, ecommerce-focused media. A small group of creators dominates sponsorships because they have niche authority. However, most operate independently with fragmented sales processes and no funding for new content creation.

I see an opportunity to unite strong content creators, build a shared sales engine, and package sponsorship offerings, similar to how The Ringer network scaled before being acquired by Spotify. Whether it’s launching new shows or helping others monetize existing ones, it’s about building the pipeline, finding sponsors, and providing the resources many creators lack.

Many brands turn costly activities into content that drives sales. For example, Vktry (pronounced “victory”), a performance insole company, outfits entire sports teams, such as UCLA volleyball. Vktry films the training sessions and uses that authentic, authority-rich footage as ad content. What would typically be a sales or training expense becomes a marketing asset, fueling ads and reducing acquisition costs.

Another example is Alex Hormozi, co-founder of Acquisition.com, a business education firm, who hosts high-ticket weekend seminars. Attendees pay to learn, and he films the sessions for ongoing distribution. He’s essentially getting paid to produce content that generates more revenue, creating a self-sustaining cycle.

In contrast, most ecommerce brands spend heavily on production, then on distribution, and hope the ads meet their CAC goals. Finding ways to subsidize or monetize production upfront can turn marketing into a profit driver rather than a cost center.

Bandholz: Where can people follow you, learn from you, and use your services?

Holiday: Our website is CommonThreadCo.com. I’m on X (with open DMs) and LinkedIn.