Amid the hoopla surrounding next month’s Prime Day, it’s worth remembering the marginal impact of that event on Amazon’s overall financial performance. Measured by bottom-line profit, Amazon in 2024 is mostly a cloud computing company.

Yet millions of merchants and consumers rely on Amazon’s marketplace. What follows is our analysis of the company’s overall financial performance and its plans for shoppers, sellers, logistics, and more.

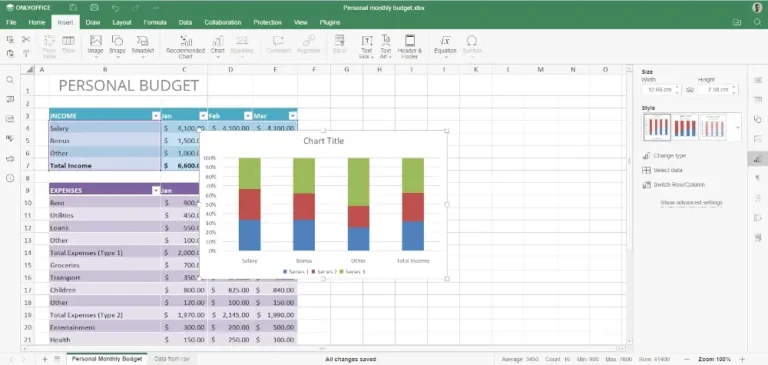

Assessing Amazon’s financials requires a bit of scrutiny. The company, famously opaque for what it discloses (and doesn’t disclose), operates three components.

The first is physical and digital goods that it carries as inventory and sells directly to consumers either online or through its outlets such as Whole Foods Markets. Amazon calls this component “Product sales.”

Next is what the company calls “Service sales.” It consists of commissions from its massive marketplace and related fulfillment, shipping, and advertising revenue. Grouped into Service sales are Prime membership fees and, notably, fees to Amazon Web Services, its monster cloud-computing division.

For purposes of this article, however, AWS is a separate component given its size and profitability.

All told, the three components generated $143.3 billion in Q1 2024 revenue, a 13% increase from the first quarter a year earlier.

Operating income for Q1 2024 reached $15.3 billion, much higher than the $4.8 billion a year earlier.

Big-picture takeaways are this.

- Amazon is highly dependent on AWS. The cloud division drove all operating income (net sales less operating expenses) in the first quarter last year and roughly 62% this year.

- “Product sales,” while modestly growing, are likely only marginally profitable, at best, given the presumed cost of goods attached to that category. Amazon does not report operating income for Product sales alone.

- “Service sales” (excluding AWS), with “Third-party seller services” (marketplace commissions and related), “Advertising services,” and “Subscription services” (Prime memberships, mostly), could easily be more profitable than “Products.” But, again, Amazon doesn’t separately report operating income for Services. Here’s the revenue breakout, however, for those items.

According to Marketplace Pulse, Amazon pockets more than 50% of marketplace seller revenue, up from 40% five years ago. A typical Amazon seller, per Marketplace Pulse, pays a 15% transaction fee, 20-35% in Fulfillment by Amazon fees, and up to 15% for advertising and promotions on Amazon. The total fees vary depending on the category, product price, size, weight, and the seller’s business model.

Delivery and AI

Amazon delivers to Prime members faster than ever, with more than 2 billion global packages arriving the same or next day in the first quarter. In March, across the top 60 largest U.S. metro areas, nearly 60% of Prime member orders arrived the same or the next day, and in London, Tokyo, and Toronto, three out of four items were delivered the same or the next day.

Whole Foods and Amazon Fresh now offer a grocery subscription service with unlimited delivery on orders over $35. The program is available to Prime members in more than 3,500 U.S. cities, as well as customers using an Electronic Benefits Transfer card, i.e., those using government benefits.

Amazon continued rolling out Rufus, its generative artificial intelligence shopping assistant, to millions of U.S. customers. The bot, still in beta, can answer shopping-related questions, compare and recommend products, and more. Amazon said it improved Rufus’s accuracy and response speed and added features, including “My Orders,” which answers questions such as “when did I last order coffee?” and “what dog treats did I last order?”

The company continues adding generative AI features for marketplace sellers. One new tool allows sellers to sync product listings from their own websites by providing a URL. The program parses the information from the websites to create “high-quality, engaging listings” on Amazon.

Profitability

Amazon reported net income (operating income less taxes and extraordinary items) of nearly $37.7 billion for the 12 months ending March 31, up 778% from $4.3 billion a year earlier. Yet the company sees further improvements ahead.

In the April earnings call, CEO Andrew Jassy stated he “doesn’t believe that we’re at the end of what we can do in terms of improving our cost structure on the Stores side [i.e., “Products sales”]. Yes, I think there are really unbelievable growth opportunities in front of us, and on the Stores profitability.”

He added, “We’re looking for ways to, again, turn over every rock, look at every process and everything that we do on the logistics side, and see how we can get our cost structure down and get speed and selection up. So, it’s working on a lot of fronts there, but cost is certainly front and center as we meet and improve customer experience.”

Profits grew immensely over the year, but the company’s operating margin percentages have not, which may be a driver of the cost concerns. Amazon reported a global net sales operating margin of 8% for the 12 months through March 31, compared to 2.5% a year earlier. That figure for North America totaled 5.2% through March and -0.1% a year earlier. The figures for international net sales improved to -0.4% from -6.6%.

Global Logistics

In September 2023, the company introduced Supply Chain by Amazon, offering third-party logistics worldwide.

“It really kind of, in some ways, mirrors some of the other businesses we’ve gotten involved in, AWS being an example of it,” Jassy said on the call.

The service helps sellers get items across borders and through customs. It also ships items from customs to various facilities, including allowing sellers to store items in warehouses that they can automatically replenish into Amazon’s fulfillment centers or move elsewhere.

“It turns out to be pretty hard work to actually import items from overseas, get them through customs and the border, and then ship them from that point to various facilities,” Jassy said. “We built that capability for ourselves first, and then we opened up those services as individual services to our sellers.”

Supply Chain by Amazon is “growing very significantly. It’s already what I would consider a reasonable-sized business,” Jassy said, adding that it’s still early for the low-capital program.